Mutual Funds Sahi hai

Mutual funds are among the most popular investment instruments available to individuals today. They offer investors an opportunity to pool their money together and invest in a diversified portfolio of stocks, bonds, or other securities. Managed by professional fund managers, mutual funds provide a convenient and relatively low-risk way for investors to participate in the financial markets.

What are Mutual Funds?

A mutual fund is an investment vehicle that collects money from multiple investors and invests it in a diversified portfolio of assets such as stocks, bonds, and other securities. The fund is managed by a professional fund manager who makes investment decisions on behalf of the investors. The primary objective of a mutual fund is to generate returns for investors while minimizing risks through diversification.

Advantages of Mutual Funds

Mutual funds offer diversification, reducing risk by spreading investments across assets. They are professionally managed, ensuring expert fund selection and strategy. With options like SIPs, they enable disciplined investing, even with small amounts. Mutual funds provide liquidity, allowing easy withdrawals when needed. They also offer tax benefits on select funds. Transparency through regular reports helps investors track performance. Regulated by SEBI, they ensure security, making them ideal for long-term wealth creation.

Professional Management

Skilled professionals manage investments, analyze markets, and optimize portfolio performance.

Liquidity

Liquidity means mutual funds can be easily bought or sold anytime.

Affordability

Start investing with a small amount, making it accessible for all.

Tax Benefits

Certain mutual funds offer tax deductions and exemptions, reducing tax liability.

Return

Return refers to the profit or loss earned on an investment.

Diversification

Spreads investments across assets, reducing risk and enhancing portfolio stability.

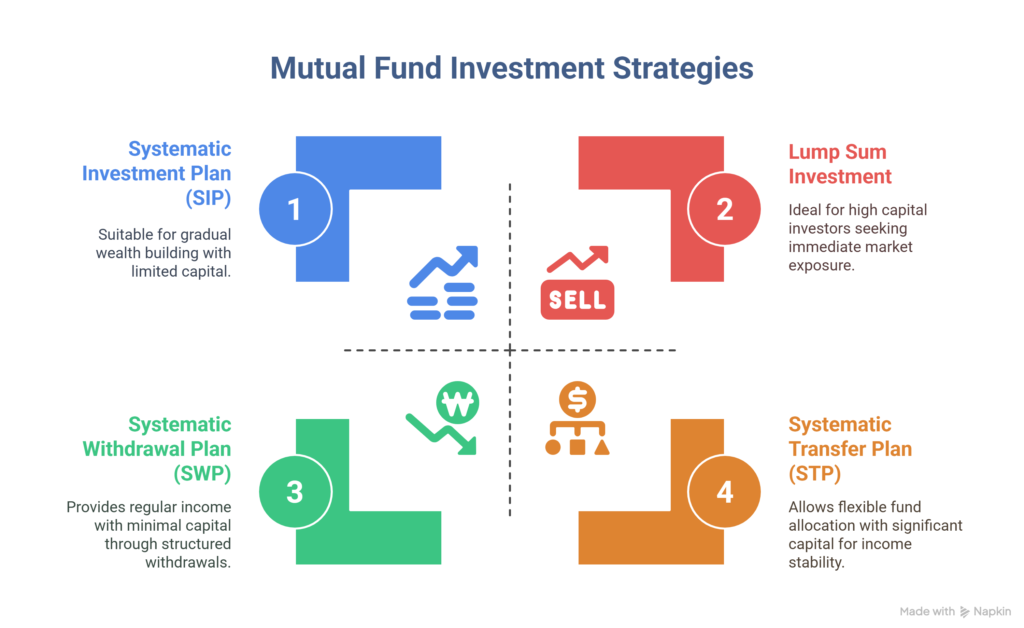

Ways to Invest of Mutual Funds

Lump Sum Investment

A one-time investment for those seeking long-term growth with market returns.

Systematic Investment Plan

Invest fixed amounts regularly, benefiting from rupee cost averaging and compounding.

Systematic Transfer Plan (STP)

Gradually shift investments between funds to balance risk and optimize returns.

Systematic Withdrawal Plan

Withdraw fixed amounts periodically while keeping the rest invested for growth.

Mutual funds provide an effective way to build wealth over time. They offer a mix of risk and return options suitable for different investors. However, choosing the right fund requires careful research and alignment with financial goals. By understanding different mutual fund types, risks, and benefits, investors can make informed decisions to secure their financial future.

| Company | Description | Risk Level | Returns Potential | Best For | Liquidity | Tax Benefits |

|---|---|---|---|---|---|---|

| Equity Funds | Invests in stocks for long term growth. | High | High | Growth-oriented investors | Moderate | Tax-saving ELSS available |

| Debt Funds | Invests in bonds and fixed-income securities. | Low | Low to Medium | Conservative investors | High | Tax-efficient for long term |

| Hybrid Funds | Mix of equity and debt for balanced growth. | Medium | Medium | Moderate Risk Takers | Moderate | Depends on fund type |

| Liquid Funds | Invests in short-term securities for stability. | Very Low | Low | Parking Surplus Cash | Very High | Tax-efficient for short terms |

| Index Funds | Tracks a market index like NIFTY or SENSEX. | Medium | Market Linked | Passive Investors | High | No Special Tax Benefits |

| ELSS (Tax Saving Fund) | Equity-based fund with tax benefits. | High | High | Taxpayers & Long Term Investors | Moderate | ₹1.5L tax deduction (Section 80C) |

| Sectoral/Thematic Funds | Focuses on specific sectors like IT, Pharma. | High | High | High-risk, focused investors | Low | No Special tax benefits |

| International Funds | Invests in global markets for diversification. | High | High | Global exposure seekers | Moderate | Tax depends on duration |

| Company | Description | Risk Level | Returns Potential | Best For | Liquidity | Tax Benefits |

|---|---|---|---|---|---|---|

| Equity Funds | Invests in stocks for long term growth. | High | High | Growth-oriented investors | Moderate | Tax-saving ELSS available |

| Debt Funds | Invests in bonds and fixed-income securities. | Low | Low to Medium | Conservative investors | High | Tax-efficient for long term |

| Hybrid Funds | Mix of equity and debt for balanced growth. | Medium | Medium | Moderate Risk Takers | Moderate | Depends on fund type |

| Liquid Funds | Invests in short-term securities for stability. | Very Low | Low | Parking Surplus Cash | Very High | Tax-efficient for short terms |

| Index Funds | Tracks a market index like NIFTY or SENSEX. | Medium | Market Linked | Passive Investors | High | No Special Tax Benefits |

| ELSS (Tax Saving Fund) | Equity-based fund with tax benefits. | High | High | Taxpayers & Long Term Investors | Moderate | ₹1.5L tax deduction (Section 80C) |

| Sectoral/Thematic Funds | Focuses on specific sectors like IT, Pharma. | High | High | High-risk, focused investors | Low | No Special tax benefits |

| International Funds | Invests in global markets for diversification. | High | High | Global exposure seekers | Moderate | Tax depends on duration |

FAQs

What Is a Mutual Fund & How Does It Work?

A mutual fund pools money from multiple investors and invests across assets like equities and debt. Investors receive units based on their contribution, and a fund manager oversees investments to maximize returns. Gains or losses are shared proportionally among unitholders..

What Is the Minimum Amount Required to Invest in Mutual Funds?

Start investing in mutual funds with just ₹500 through SIPs!

How Do I Earn Returns from Mutual Funds?

You can earn from mutual funds through:

Returns vary based on market performance and underlying assets.

Can I Redeem My Mutual Funds Anytime?

Most open-ended mutual funds offer anytime redemption at the current NAV. However, some may have an exit load (0.5%–1%) if withdrawn early. ELSS funds have a mandatory 3-year lock-in period.

What Is the Expense Ratio and Exit Load in Mutual Funds?

The expense ratio is the fund’s annual management fee, while the exit load is a penalty for early withdrawals.

Are Mutual Funds Regulated in India?

Yes, all mutual funds in India are regulated by SEBI, ensuring transparency and safeguarding investor interests.